As educator wages struggle to keep up with rising costs of living, teacher bankruptcy unfortunately is far too common.

Teacher Bankruptcy – What are the Causes?

While in the past bankruptcy was a means of evading creditors, today the pandemic has a more sinister basis. Ranging from poor money management skills to personal calamities such as divorce and medical emergencies, financial pressures today are pushing many Americans to file for bankruptcy. Here we look at the top 5 most common causes of bankruptcy. How can you avoid a teacher bankruptcy and becoming a part of the bankruptcy statistics?

Medical Expenses

Medical expenses are the leading cause of bankruptcies in the United States today. Rising medical costs coupled with deteriorating health due to poor lifestyle choices combine to exert extraordinary pressure on individuals and families in the US today.

To avoid going down this road, try the following. Take care of your health. Fewer visits to the doctor mean fewer expenses. Find an insurance plan with low deductibles and other extra payments that fits your needs. Are you eligible for the deductions? Finding out could save you money.

Losing a Job

Whether through downsizing, retirement or resignation, losing a job always comes with a financial shock. The regular paycheck may be gone, but bills keep coming in. If you cannot find a job fast enough, this pressure can exhaust your savings and leave you with few options.

If you are still employed, avoid this bankruptcy trap by building up your emergency fund. Put aside 6 months to a year of living expenses. If you do lose your job, you will be able to survive for this period without the need to touch any of your other investments or savings.

Poor Use of Credit

Excessive use of credit is the third trap that leads many to bankruptcy court. Splurging on expensive things bought using credit is a poor financial choice. Yet many will do this without a second thought. The trap here is the fallacy that credit cards offer free money.

To avoid this, limit your use of credit cards and other forms of credit. In fact, go as far as only having one credit card, which you can easily track. You may also consider using a debit card instead of a credit card, so you know you are only spending what you have.

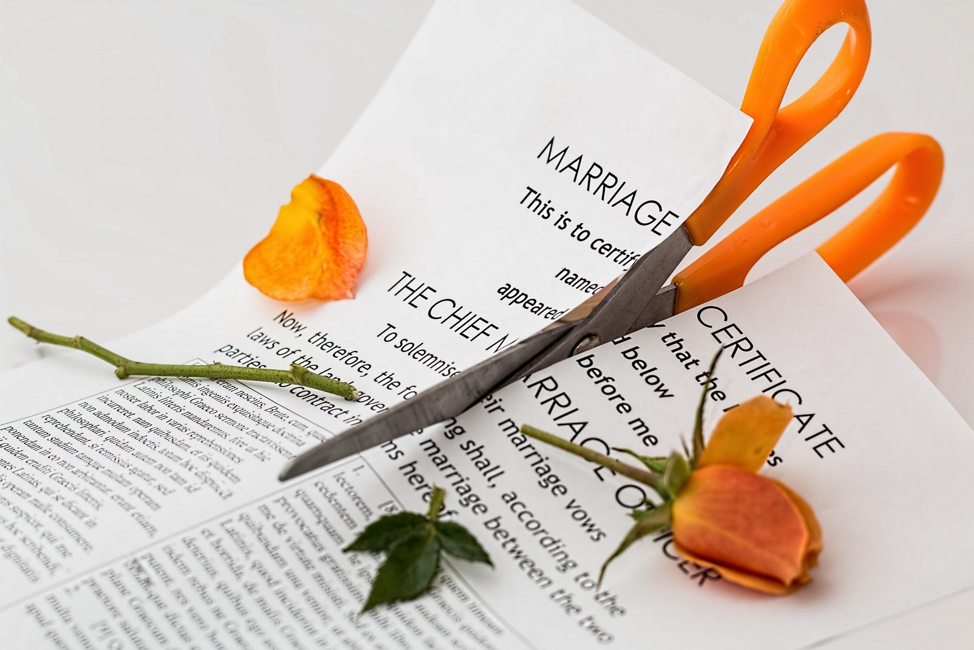

Separation/Divorce

Divorces and separations come with serious financial ramifications that leave many a divorcee bankrupt. Legal fees coupled with other costs such as child support and alimony may leave one or both partners financially strained.

Considering in some cases the court can decree back payments, this is a common reason for bankruptcies in the US. To avoid this, maintain a good handle of all your assets and obligations so that if this does happen, you are prepared.

Unforeseen Expenses

These occur through loss of property from natural disasters, theft, fraud and a host of other reasons. When this happens, the affected party is usually unable to recoup the loss. If the loss was tied to some form of lien or income, they may find themselves financially overwhelmed. To protect yourself, maintain insurance on all properties that you deem crucial to your financial wellbeing.

While some of these reasons for teacher bankruptcy are unavoidable, in most cases sound planning, judicious fiscal discipline, and adequate preparation can mitigate, if not avert, these financially-ruinous events.